Planning for Long-Term Care

Planning for long-term care is more important than it has ever been. People are living longer, increasing the risk of needing some sort of care as our bodies get older and break down. It’s important to consider the toll providing care takes on the spouses, children and friends of those with long-term care needs. The monetary toll can be significant, but the mental and physical toll on caregivers can be just as impactful.

Where does the burden lie? A CFM client disregarded long-term care funding concerns, assuming it was something they could self-fund. When a family member had a long-term care need, however, the true costs began to hit home. Fortunately, they managed to find a long-term care insurance (LTCI) policy in the family member’s files. The relief of not having to pay out of pocket for that family member’s care made our client realize that a LTCI policy could protect his children from potentially having to bear the same burden.

On a personal side note, this is the reason that my father, Bob, states at most family gatherings that the kids should be pitching in for the policy he and my mother own. We respectfully decline each time, which surprisingly does not stop him from asking again at the next gathering.

There are multiple options when deciding on a long-term care policy type. I will concentrate on the two types that we, here at Carter, utilize the most; traditional long-term care insurance and asset based long-term care insurance.

Traditional long-term care insurance is a lot like your auto insurance.

•If you don’t use it, you lose it. Any premium payments are not refundable whether or not you use the coverage during your lifetime.

• There is an annual premium that you pay until you go on claim, or you pass on. That premium is not guaranteed and can go up over time.*

• The traditional policy can be more affordable than the as-set-based care. The leverage you receive is greater because it does not have all the bells and whistles of asset-based products.

Asset based long-term care insurance was created to address some of the issues associated with traditional long-term care insurance.

• Asset based LTCI requires a large upfront payment. We usually start with $100,000 and work up or down from there depending on the coverage need.

• It’s not ‘use it or lose it’ since it has a life insurance component. If you do not use the long-term care coverage, your heirs receive the life insurance.

• It’s guaranteed to pay out what your original illustration says it will pay. There will be no additional premium requested and the quote is guaranteed.

• If you decide you don’t want the policy after a few years, you can cash it in. You can set this up to be an 80% return of premium or 100% return of premium.

• Some policies are now beginning to use the stock market to cover inflation protection.

You can see that the asset-based option takes many of the concerns of a traditional policy and attempts to ‘fix’ them. Both are very valid options, and we utilize both strategies depending on each client’s unique situation.

There are many factors to consider in determining your need for LTCI, as well as how much coverage you may potentially need.

• How much guaranteed income do you have, including pensions, Social Security and annuities? These could offset your long-term care expenses and reduce the monthly insurance benefit need.

• How do you feel about tapping some of your assets to pay for potential care?

• Do you own your home outright? Depending on your feelings about your home as an asset, partially fund-ing care using your home could make sense.

No matter how much money you have or plan to have as you head into retirement, long-term care coverage is important. Although paying a $7,000 monthly expense for 3 or 4 years of care may be easily manageable for some, a dementia claim can cost upwards of $15,000 to $20,000 a month for a quality facility. A quarter of a million dollars a year will get anyone’s attention, especially since a dementia claim can run 10 years or more.

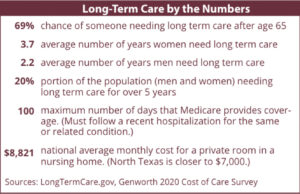

The hope is that none of us will need long-term care—but the reality is that if we live to be 65, two-thirds of us will. Talk to your planner about the options available through Raymond James and check out the websites below for additional information.

Please visit the Texas Department of Insurance at https://www.tdi.texas.gov/pubs/consumer/cb032.html or LongTermCare.gov for additional information on Long Term Care Insurance.

*Historically, premium increases have come with a choice; ei-ther lower your coverage or pay the additional premium. In the past, this was a frequent occurrence because pricing of the pol-icies did not consider the rapidly increasing costs of care. These days, the cost of care is understood to be inflating by 3-5% and I have been assured by multiple traditional care insurers that the initial pricing is set to ensure that minimal, if any price increases should happen in the future.

The information has been obtained from sources considered reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Joel Berg and not necessarily those of RJFS or Raymond James. Links are being provided for information purposes only. Expressions of opinion are as of this date and are subject to change without notice. Raymond James is not affiliated with and does not en-dorse, authorize, or sponsor any of the listed websites or their respective sponsors. LTC Guarantees are based on the claims paying ability of the issuing company. Long Term Care Insur-ance or Asset Based Long Term Care Insurance Products may not be suitable for all investors. Surrender charges may apply for early withdrawals and, if made prior to age 59 ½, may be subject to a 10% federal tax penalty in addition to any gains being taxed as ordinary income. Please consult with a licensed financial professional when considering your insurance op-tions.

Linkedin

Linkedin Facebook

Facebook Twitter

Twitter Youtube

Youtube